Stablecoins are no longer just for traders.

What began as a tool for crypto traders is quickly becoming critical infrastructure for modern finance. From Wall Street to West Africa, stablecoins are powering everything from institutional settlements to payroll and cross-border commerce. They offer the speed of digital payments with the stability of fiat currencies—without relying on traditional banking systems.

In Part 1 of this series, we explored how stablecoins work and why they're foundational to digital finance. Now, in Part 2, we focus on how they’re being used in practice—and how regulators are racing to bring clarity to this rapidly evolving landscape.

To understand where stablecoins are heading, we first need to understand how they’re being used today.

Where Stablecoins are Used Today

Trading and liquidity infrastructure

Stablecoins may be evolving beyond crypto-native use cases, but trading still accounts for the vast majority of their volume. A recent study found that out of $2.2 trillion in monthly stablecoin transfers, only 7% were organic payments; the remaining 93% came from trading bots and exchange activity.

Source: Visa, Allium

Most of this activity takes place on centralized exchanges (CEXs) like Binance and OKX, where stablecoins such as USDT serve as the dominant quote currency for crypto trading. By maintaining a consistent dollar value without requiring off-ramps to fiat, stablecoins offer traders a fast, liquid, and stable unit of account—ideal for moving in and out of volatile assets like BTC and ETH.

But this trading-heavy activity also reveals a broader market gap: while stablecoin infrastructure is proven at scale, it remains largely untapped by businesses and institutions. The same properties that make stablecoins ideal for traders—speed, stability, 24/7 access—are equally valuable in enterprise use cases like cross-border treasury, invoice settlement, and supplier payments. The pipes are built, but the most valuable users haven’t entered the system yet.

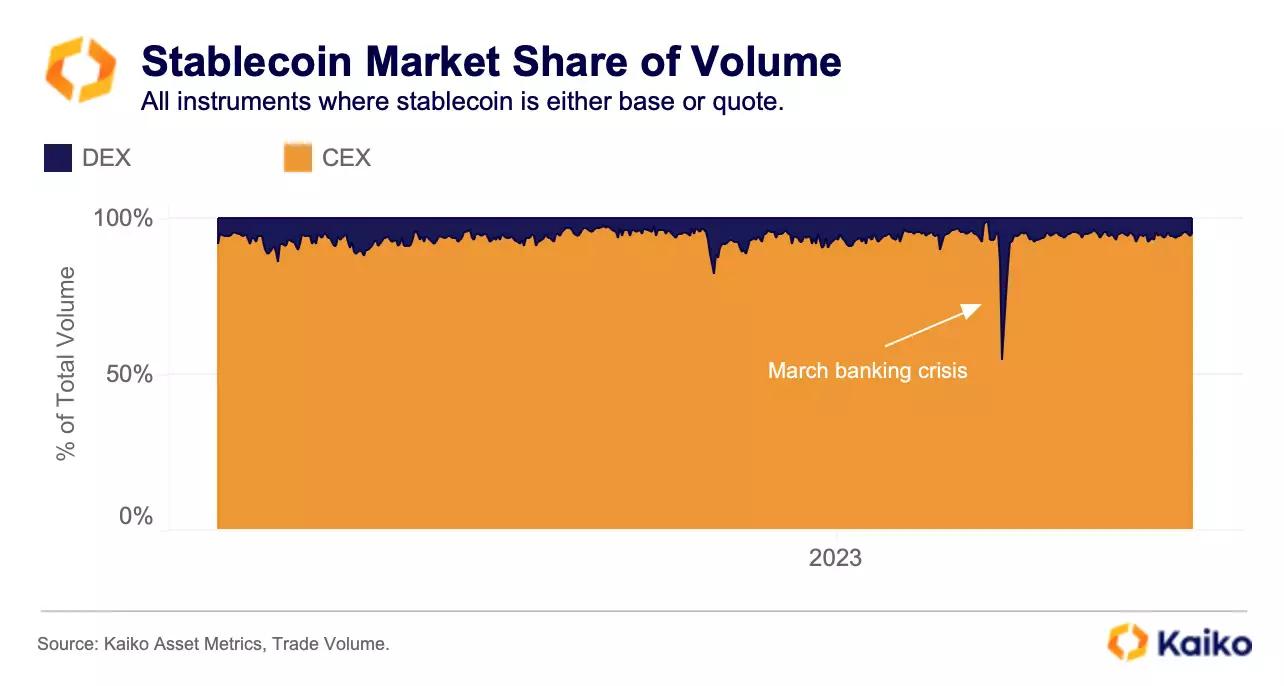

Decentralized exchanges (DEXs) like Uniswap and Raydium handle a smaller share of stablecoin volume—typically just 5–8%—but play an essential role in the DeFi ecosystem. Stablecoins on DEXs are used in automated market makers (AMMs), lending protocols, and onchain yield strategies. And during periods of market volatility, DEX volumes can surge dramatically.

Source: kaiko

One such moment came in March 2023, during the collapse of Silicon Valley Bank (SVB). As news broke that Circle held part of USDC’s reserves at SVB, the stablecoin briefly depegged, falling to $0.87. Onchain swap volumes spiked, and DEXs temporarily captured up to 45% of all stablecoin trading—highlighting their role as decentralized, always-on liquidity alternatives when centralized platforms falter. Once U.S. regulators guaranteed SVB deposits, USDC regained its peg. But consumer trust had been damaged—USDT grew in market share while USDC lost ground in the months that followed.

The incident also exposed an uncomfortable truth: traditional bank accounts are not backed 1:1. Most U.S. banks operate on a fractional reserve basis, meaning depositors’ money is largely lent out or reinvested. In contrast, properly structured stablecoins (especially those held in bankruptcy-remote trusts and backed by short-term treasuries) can offer greater transparency and protection—making them potentially safer for holding short-term value.

The divergence between CEXs and DEXs reveals more than just infrastructure preferences—it reflects the growing complexity of how stablecoins move through the digital economy. As enterprise adoption increases, both environments will need to interoperate—potentially with tools like PYUSD acting as a bridge between traditional finance and onchain infrastructure.

Emerging Market Adoption

While crypto trading still dominates global stablecoin volume, adoption in emerging markets is accelerating—and creating clear signals for business opportunity.

In regions with unstable currencies and limited access to traditional banking, stablecoins are filling urgent gaps in the financial system. According to Chainalysis, stablecoins account for nearly 80% of all crypto transaction volumes in Sub-Saharan Africa. In fact, stablecoins are the most widely used crypto assets for value transfer across emerging markets where currency volatility and financial exclusion help to drive adoption. They’re used for payments, remittances, savings, and day-to-day commerce—offering a digital dollar substitute in places where inflation, transfer fees, and banking exclusion are the norm.

The cost advantage is dramatic. A World Bank report found that sending a $200 remittance to the region via traditional rails costs an average of 8.3%. Using USDC or USDT can cut that to under 0.1%—saving senders more than 98% in fees.

While the data reflects consumer remittances, the implications for business are even greater. Any company making regular cross-border payments—whether to suppliers, contractors, or regional subsidiaries—stands to gain significant cost and speed advantages by shifting to stablecoin rails. The infrastructure works. What’s missing is broader enterprise adoption.

In countries like Argentina and Nigeria, where inflation can erode local currency value overnight, consumers increasingly turn to stablecoins like USDT as digital cash. In Argentina alone, over 60% of crypto users regularly convert pesos into stablecoins to hedge against depreciation.

These patterns may appear grassroots, but for global businesses, they’re strategic signals. Enterprises operating in high-volatility markets can use stablecoin rails not just to reduce payment costs—but to preserve capital, stabilize operations, and build financial trust in environments where traditional systems fall short. The infrastructure is live, and the demand is proven. What’s missing is the enterprise layer to activate it at scale.

Enterprise and Institutional Use Cases

As regulatory clarity improves and digital infrastructure matures, enterprises are beginning to adopt stablecoins well beyond speculative trading.

Wall Street firms like Franklin Templeton and BlackRock are using USDC to settle tokenized money market funds—unlocking 24/7 transaction finality while bypassing legacy clearing systems. In some cases, stablecoins are now being used to settle vendor invoices within minutes, even outside of banking hours.

JPMorgan, an early mover in enterprise blockchain, has built out its own infrastructure for stablecoin settlement. These aren’t proofs of concept—they’re live, operational systems reducing friction in institutional finance.

For enterprises, the value proposition is taking shape: faster settlement, reduced fees, and the ability to move capital around the clock. But perhaps more importantly, stablecoins introduce programmable liquidity—money that can move with conditional logic, settle automatically across systems, and support workflows that traditional rails can’t match.

As adoption shifts from pilots to production, stablecoins are beginning to function as a new layer of financial infrastructure—one designed for global scale, digital speed, and enterprise-grade control.

Medium of Exchange vs. Store of Value

Stablecoins were designed for movement—and onchain data confirms that’s how they’re used. Compared to assets like Bitcoin, which tend to sit idle in wallets, stablecoins show high turnover. Their supply frequently changes hands, reflecting their core utility as digital dollars for fast, low-cost transfers.

But in unstable economic environments, stablecoins are also being used as a store of value. In countries like Lebanon and Venezuela—where local currencies suffer from chronic inflation and capital controls—people are holding stablecoins for weeks or months at a time to preserve purchasing power. In these regions, stablecoins behave less like a payment rail and more like a digital savings account.

Source: IMF

This dual nature—spendable and storable—is part of what makes stablecoins uniquely useful. They function like a checking account in one context and a vault in another. And for businesses, that dynamic unlocks more than operational utility—it unlocks behavioral data. Each stablecoin transaction generates onchain signals that can help enterprises better understand customer behavior, regional demand, partnership opportunities, and usage patterns across ecosystems.

In the future, this data layer may become just as valuable as the payment function itself—especially for institutions looking to deepen relationships with users in markets where visibility and trust are harder to come by.

Stablecoins and U.S. Dollar Dominance

How Stablecoins Are Expanding the Dollar’s Reach

Stablecoins may be digital assets, but they’re also monetary instruments—and the overwhelming majority are backed by the U.S. dollar. According to industry research, roughly 99% of all stablecoins are pegged to the U.S. dollar, extending the dollar’s reach into regions where traditional U.S. banking infrastructure is limited or unreliable.

In parts of Africa, Latin America, and Southeast Asia, stablecoins are enabling people and businesses to transact, save, and settle in digital dollars—without needing a U.S. bank account. From merchant payments in Nigeria to remittances in El Salvador, stablecoins are fueling a form of digital dollarization that’s happening by code, not by policy.

Source: Chainalysis

Crucially, these assets do more than just circulate dollars—they embed USD into the financial infrastructure of emerging economies. Onchain settlement, payroll, lending, and cross-border trade increasingly rely on USDC, USDT, and other stablecoins. In some regions like Turkey, Argentina, and Venezuela, usage of stablecoins now rivals or exceeds that of local currency in crypto transactions.

Why Washington sees Stablecoins as a Strategic Asset

This trend has major geopolitical implications. The dollar has long been the world’s reserve currency, but in the digital age, stablecoins are reshaping how it moves—and who can access it. By embedding programmable dollars directly into global financial infrastructure, stablecoins have the potential to extend U.S. monetary influence far beyond the reach of traditional banking rails.

Washington has taken notice. As global interest in digital currencies grows, U.S. policymakers are increasingly framing dollar-pegged stablecoins as a national strategic asset—one that can preserve and expand dollar dominance in an evolving digital economy. Congressional leaders and financial regulators have argued that with the right legal framework, the U.S. could cement the dollar as the default currency for the internet, especially as rivals like China and the EU accelerate development of their own state-backed digital currencies.

That policy shift is already underway. In January 2025, President Trump signed an executive order titled "Strengthening American Leadership in Digital Financial Technology", formally supporting lawful, dollar-backed stablecoins while rejecting government-issued digital currencies. The administration has taken a clear stance: CBDCs should not be developed or adopted in the U.S. This position was echoed in a February 2025 bill proposed by Senator Mike Lee, which recommends a permanent ban on the creation of a U.S. central bank digital currency.

Across the aisle, other lawmakers see stablecoins as an opportunity to reinforce the dollar’s role in global commerce—not just as a reserve asset, but as programmable infrastructure. The regulatory path is still being written, but If stablecoins are secure, regulated, and interoperable, they don’t just support U.S. businesses—they reinforce the dollar’s position as the centerpiece of global value exchange.

Fiat vs. Stablecoins: Speed & Cost

Traditional financial rails—especially those used for cross-border transactions—are slow, expensive, and fragmented. Stablecoins, by contrast, offer a programmable, global-ready infrastructure that dramatically reduces both cost and settlement time.

Fees

Traditional cross-border payments—whether routed through SWIFT, wire transfers, or remittance providers that rely on those networks—can carry fees between 7–13% of the transaction value. These costs are often compounded by unfavorable exchange rates and hidden intermediary charges, making international payments especially expensive for businesses and consumers alike.

By contrast, stablecoins regularly cost less than 1% to send—and often far less. On chains like Solana, the average transaction fee is just a fraction of a cent. Tron, one of the most widely used stablecoin networks in the world, routinely processes transfers of any amount for under $1 in fees.

Source:Token Terminal

Source: token terminal

Speed

Speed is another major differentiator. Stablecoins settle in seconds or minutes, 24 hours a day, 7 days a week—even on weekends and holidays. Payments are final once confirmed on-chain, offering a level of certainty and real-time visibility that legacy systems struggle to match.

Even modern “real-time” fiat systems often fall short. Bank wires, ACH, and even faster payment networks are still bound by banking hours, cutoff times, and regional holidays. And they typically lack global interoperability, making them less effective for international commerce.

Programmable, global-ready infrastructure

Stablecoins are also inherently programmable—making it possible to embed conditional logic, automate transactions, and streamline backend processes. This isn’t just faster finance; it’s smarter finance.

Together, these cost and speed advantages are not just improvements—they're enablers of entirely new financial flows. Stablecoins reduce more than just fees: they eliminate hidden FX markups, simplify settlement, and enable global transactions without reliance on legacy intermediaries.

Because of these advantages, businesses and financial institutions are beginning to integrate stablecoins into their payment rails—using them to reduce costs, speed up settlement, and unlock new global flows.

What’s Next

As adoption accelerates, the next phase of stablecoin growth will hinge on clear regulation, trusted issuers, and seamless interoperability between fiat and blockchain-based systems. Across jurisdictions—from NYDFS and MiCA to executive orders and congressional proposals—the global rulebook is taking shape.

One thing is already clear: The infrastructure for stablecoin growth and value is here. The next chapter belongs to the institutions ready to use it.