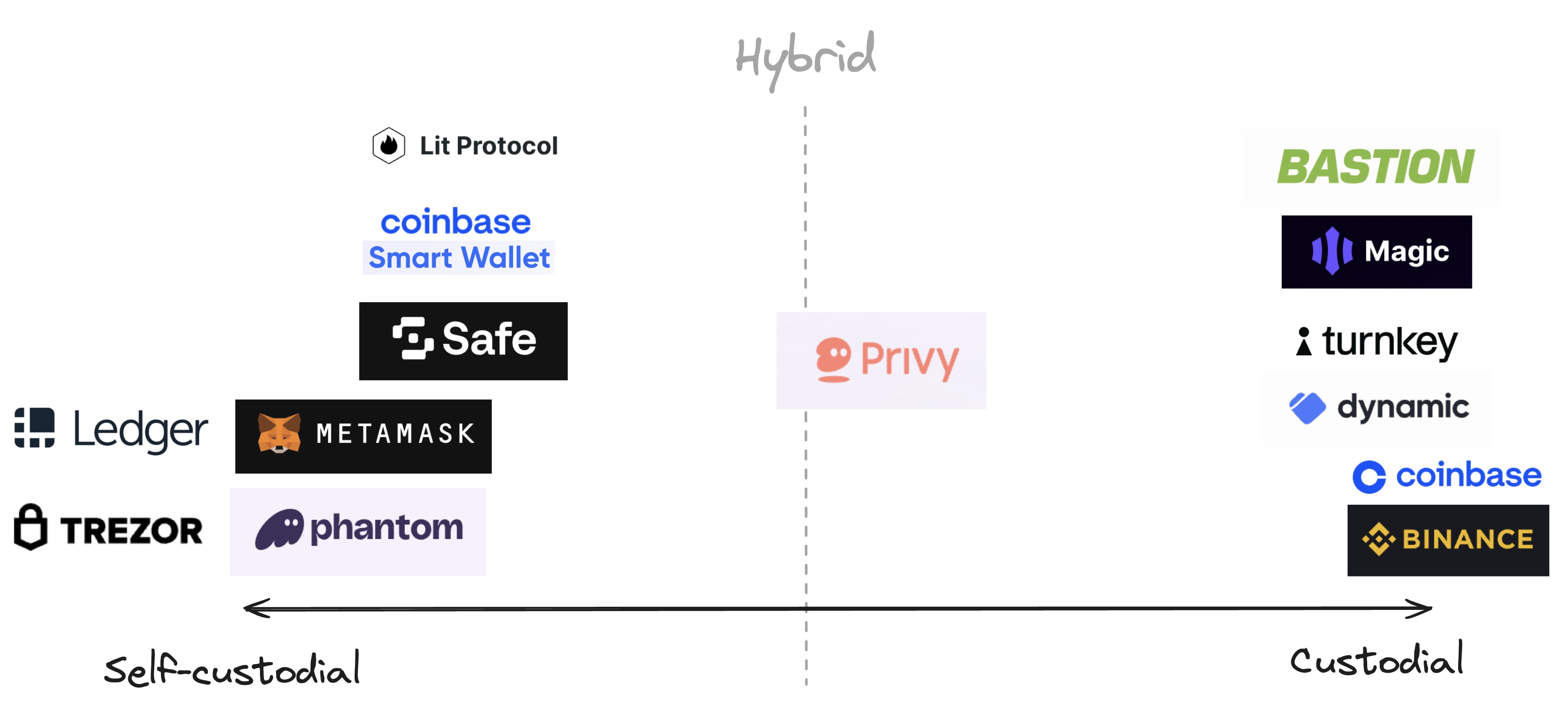

Self-Custodial vs. Custodial Wallets

The digital asset world is divided between self-custody and custodial wallets. Self-custody refers to individuals maintaining exclusive control over their private keys, ensuring they alone can access and manage their digital assets. Custodial wallets, conversely, involve a third-party service provider holding the private keys on behalf of the user.

This distinction is crucial as it affects control, security, and vulnerability to external influences. Self-custody provides unmatched control by eliminating most third-party risks, but requires users to take full responsibility for key management. Custodial wallets offer convenience and added layers of security managed by experts, but inherently involve trust in the service provider.

A concerning trend sees some companies mislabeling secure custodial wallet setups as "self-custodial," creating a false sense of trustlessness among users. This misrepresentation can lead to misaligned trust assumptions and vulnerability to risks that true self-custody would avoid. Users must recognize these differences to make informed decisions about their digital asset management strategies.

Defining Self-Custody

Self-custody is the gold standard for those prioritizing ultimate control over their digital assets. In this model, users maintain exclusive access to their private keys, ensuring no third party can interfere with their assets. This autonomy protects users from various risks, including:

- Wallet provider going out of business

- Malicious actions by the wallet provider and their employees

- Legal pressures like government subpoenas

However, achieving self-custody comes with significant responsibilities:

- Secure storage of private keys

- Use of hardware wallets or secure software solutions

- Management of backup and recovery processes

While this approach demands more effort and knowledge, it provides unparalleled security and independence. Self-custody empowers users to take full responsibility for their digital assets, ensuring complete control regardless of external circumstances.

Embedded Wallet Security Goals

The primary goal of embedded wallet security is to make hacking attempts prohibitively expensive and complex. This involves a multi-faceted approach:

- Safeguarding private keys from unauthorized access

- Ensuring keys cannot be used even if accessed

- Protecting against both external and internal threats

- Incorporating advanced cryptographic techniques

- Utilizing secure hardware environments

Protecting against internal threats is equally crucial. The embedded wallet security model must:

- Prevent misuse by insiders, such as phished or compromised employees

- Implement stringent measures to protect key management

- Enforce strict authorization access to key usage and transaction signing

- Secure code publishing and administrative access

- Use secure enclaves to isolate sensitive operations

- Employ multi-party approval processes for critical actions

These measures ensure that no single individual can compromise the system at the code logic and operational layer.

Understanding Custodial Wallet Security

Custodial wallets involve third-party management of private keys, offering convenience and additional security through measures such as:

- Multi-signature schemes requiring multiple approvals for transactions

- Hardware security modules (HSMs) for secure cryptographic operations

- Secure enclaves (e.g., AWS Nitro Enclaves) for tamper-proof environments

- Cryptographically signed code to ensure integrity

Despite these advanced security measures, custodial wallets are not without risks:

- Reliance on third-party trustworthiness and security practices

- Vulnerability to employee phishing and social engineering attacks

- Introduction of a single point of failure due to centralized control

- Potential for government intervention or subpoenas

For most users, custodial wallets offer a practical balance between security and usability. They often provide user-friendly interfaces and customer support, beneficial for those less experienced with managing private keys. However, users must carefully evaluate the trade-offs involved and select reputable, transparent custodial wallet providers.

The Weakest Link: Humans

Human factors often represent the weakest link in any security system. Employees can become prime targets for:

- Phishing attacks

- Social engineering attempts

- Exploitation of vulnerabilities to gain access to critical systems

To mitigate these risks, wallet providers must:

- Implement comprehensive security training and awareness programs

- Educate employees about the latest phishing techniques and social engineering tactics

- Employ strict access controls and regular audits

- Implement multi-factor authentication and role-based access controls

- Foster a culture of security awareness and vigilance

- Continuously update and refine security policies and procedures

Ultimately, the effectiveness of any security system depends on the people who implement and manage it. By addressing the human element proactively, wallet providers can significantly reduce the risk of human error and malicious attacks.

The Second Weakest Link: Software

While human factors are often the primary concern, software vulnerabilities present another significant risk in wallet systems. Attack vectors include:

- Flaws in software design or implementation

- Vulnerabilities in key management software

- Supply chain attacks introducing malicious code

- Unintentional security gaps due to system complexity

To address these issues, wallet providers should:

- Employ continuous code audits and rigorous testing

- Use multi-party approval processes for software updates, deployments, and code signing

- Build robust unit, integration, and fuzzing testing infrastructure

- Guard against inadvertent logging of secrets and logic bugs bypassing authorization controls

- Implement formal verification methods for critical components

Despite these precautions, the inherent complexity of software means it will always present a potential risk, reinforcing the need for robust, multi-layered security strategies in wallet solutions - custodial or self-custodial.

The Myth of "Self-Custodial" Custodial Wallets

A concerning trend is the marketing of custodial wallets as "self-custodial." This mislabeling creates significant issues:

- False sense of security among users

- Belief in exclusive control when third-party control exists

- Vulnerability to risks that genuine self-custody would avoid

True self-custody means only the user has access to their private keys, with no third-party intervention possible. Custodial wallets, despite their security measures, remain subject to legal mandates and operational failures.

This misrepresentation can lead to inadequate security precautions by users and potential loss of control over digital assets.

Clear communication about the nature of custodial and self-custodial wallets is essential for users to make informed decisions about their digital asset management.

Government Intervention and Subpoenas

Custodial wallets are legally subject to government intervention, which can include subpoenas requiring the service provider to block access to wallets or reveal private keys. These actions can be taken without the user's consent or knowledge, which means that the setup is not self-custodial.

Custodial wallet providers might comply with such requests by:

- Updating Key Management Service (KMS) admin settings

- Modifying code in Hardware Security Modules (HSMs) or Secure Enclaves

- Issuing transactions to government-controlled custody accounts

This potential for government intervention highlights a significant difference between custodial and self-custodial wallets. While custodial solutions may offer enhanced security against hacking, they cannot provide the same level of autonomy and protection from external control that self-custody offers.

Security is not Self-Custody

To achieve true self-custody, individuals must maintain exclusive access to their private keys, ensuring that no third party can interfere. This can be achieved through the use of hardware wallets or secure software solutions that allow users to manage their keys independently. Hardware wallets provide a physical device that securely stores private keys offline, significantly reducing the risk of online attacks. Secure software solutions can also offer robust key management features, provided they are used correctly and securely.

True self-custody requires diligence and a commitment to security best practices. Users must take responsibility for their key management, including secure storage and backup of private keys. Regularly updating software, using strong passwords, and employing multi-factor authentication are essential practices for maintaining security. Additionally, users should be aware of the risks associated with losing access to their private keys and implement reliable backup solutions to prevent irreversible loss.

The benefits of self-custody are significant for those willing to invest the time and effort. By eliminating reliance on third parties with remote control over one’s keys, users can ensure the privacy, security, and integrity of their digital assets. This level of autonomy is especially important in an era where digital assets play an increasingly critical role in personal and financial security. For users who prioritize control and independence, self-custody is the best way to safeguard their digital assets against external threats and interventions.

Conclusion

Understanding self-custody and custodial wallets is key for digital asset management. Custodial wallets offer user-friendly interfaces, advanced features, and expert-designed security measures, providing convenience and peace of mind. Self-custody provides full control but requires more user responsibility.

Most embedded wallets today are custodial. Companies can potentially access user assets without consent by adjusting backend settings or deploying new code. Users and businesses leveraging these custodial embedded wallets should ensure providers have appropriate regulatory compliance, such as money transmitter licenses, broker-dealer licenses, or limited purpose trust charters. These regulations require providers to have insurance, financial audits, security audits, and other consumer protections. This oversight adds an important layer of security and accountability to custodial solutions.