The world’s largest financial institutions don’t pursue major infrastructure shifts lightly. When JPMorgan (JPM), the largest bank in the U.S., launched JPM coin in 2019 and later introduced Kinexys (formerly Onyx) in 2020 to expand blockchain-based settlement and wholesale payment capabilities, it signaled a shift in global finance. This wasn’t about chasing trends—it was about solving fundamental inefficiencies in traditional payment systems. Stablecoins, digital assets that track to the value of traditional money like USD, have emerged as a real solution for modern institutional transactions, and JPM’s adoption presents a case study for their growing value. In this article, we’ll take a closer look at JPM’s use of blockchain technology for settlement processes.

For businesses moving substantial capital, stablecoin-based settlements’ speed, transparency, and cost savings provide a competitive edge. Recognizing these advantages, JPM designed Kinexys to leverage blockchain to deliver a low-cost, secure alternative to legacy systems. The platform now enables payments anywhere in the world for a fraction of a penny while reducing friction in cross-border transactions and boosting liquidity. By integrating this technology into its settlement framework, JPM addresses longstanding internal banking inefficiencies for their institutional clients while setting a new benchmark for global payments—and paving the way for the next generation of enterprise and institutional solutions like Bastion.

Stablecoins, as Kinexys demonstrates, are not just viable - they’re essential to the future of institutional finance. But what drove JPMorgan to this bold leap? The answer lies in the deep-seated flaws of traditional settlement systems that Kinexys was built to dismantle.

Why Settlement Needed a Fix: JPMorgan’s Bet on Blockchain

Global financial settlements are inefficient—plagued by delays, high costs, and heavy reliance on too many intermediaries. Traditional settlement windows can take days, tying up capital, amplifying risk exposure and creating operational bottlenecks for institutions that are moving billions across the globe. Until now, attempts to solve these challenges have resulted in incremental patchwork fixes to outdated systems. JPM saw a better way. The institution made a bet on launching a blockchain-powered solution designed to transform institutional payments, now called Kinexys.

Kinexys harnesses blockchain technology to enable direct, near-instant transactions that slash friction, lower costs, and enhance security. For JPM’s internal infrastructure and institutional clients, this means capital moves faster and more efficiently, with reduced counterparty risks and streamlined cross-border and interbank transfers. With Kinexys, JPM is starting to redefine how large-scale settlements can operate in a modern financial landscape.

The Value Proposition of Blockchain for Payment Settlement

JPM’s interest in blockchain stems from several key benefits:

- Near-Instant Settlements: Traditional settlement systems, such as SWIFT and ACH, can take days to process payments. Kinexys, by using blockchain, allows near-instant settlements while reducing counterparty risks.

- Cost Efficiency: Cross-border payments and institutional transfers involve high fees due to intermediary banks and FX conversions. Blockchain eliminates many of these inefficiencies.

- Improved Security: Distributed ledger technology ensures that transactions are tamper-proof, reducing fraud and improving traceability.

- Liquidity Optimization: By using tokenized deposits and stablecoins, institutions can free up capital that would otherwise be locked in lengthy settlement cycles.

JPM isn’t the only institution to notice these opportunities. A report by Deloitte estimates that blockchain technology can reduce cross-border payment costs by 40% to 80%, translating to potential savings of $12 billion to $24 billion annually. This data aligns with a 2023 Global Payments Report by McKinsey, which estimates cross-border payment revenues at $240 billion, with industry analyses placing yearly fees in the $25–$35 billion range. Similarly, a 2023 Boston Consulting Group (BCG) study projects that a permissioned decentralized finance (DeFi) model could cut transaction costs by 60% to 80%, potentially shaving $15 billion off operational expenses for major financial institutions.

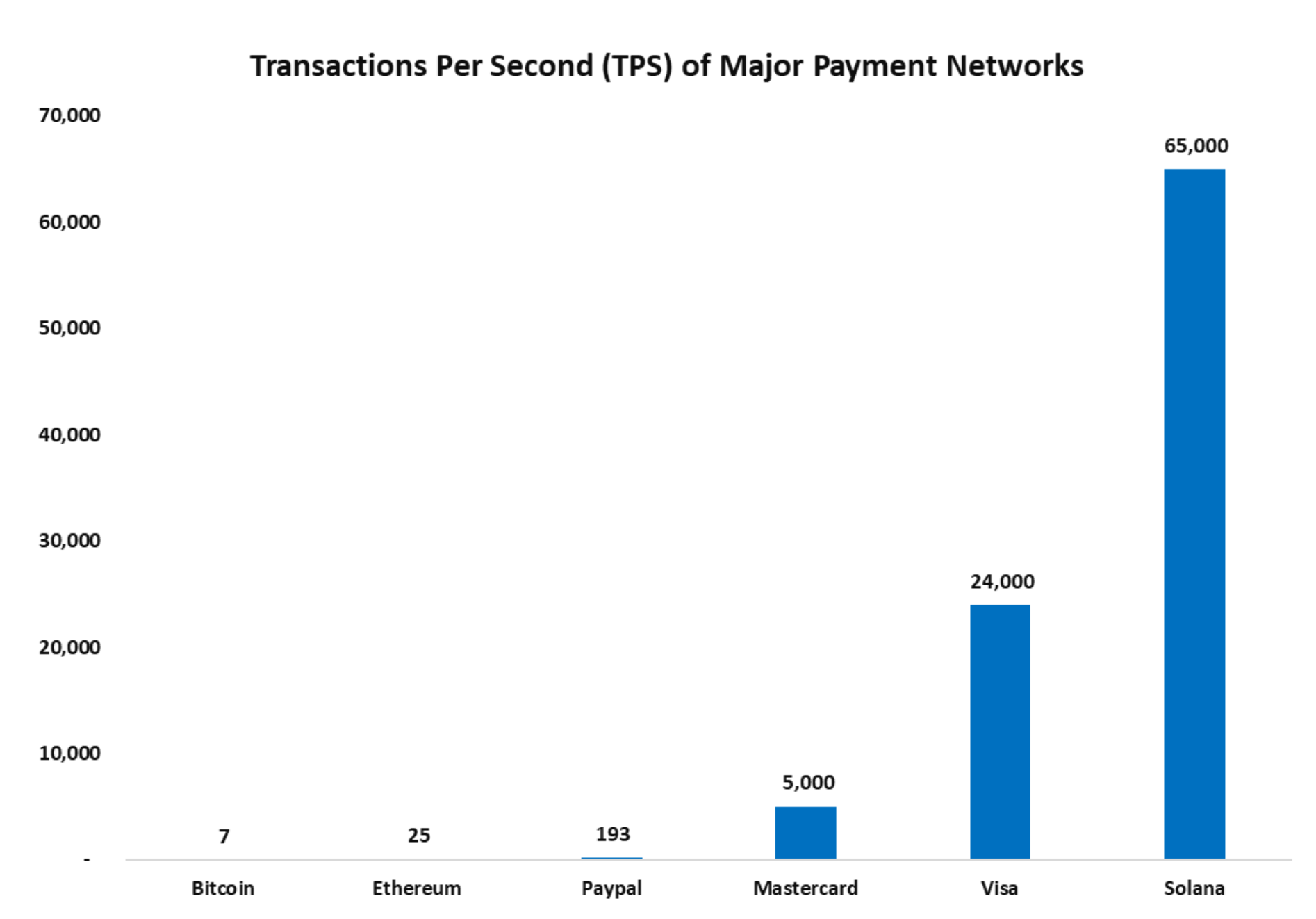

When considering the number of transactions made by major payment networks, the saving opportunity presented by stablecoins will add up quickly.

Source: Dune, Visa

By making stablecoins central to Kinexys, JPM is indicating they are a critical component of the institution’s ability to deliver on the promise of faster, more efficient settlements—their transactions remain stable while benefiting from the speed and security of blockchain technology.

The Role of Stablecoins in Large-Scale Settlements

More broadly, the adoption of stablecoins by financial institutions marks a major shift in how businesses approach settlement infrastructure. Just like JPM, firms are turning away from outdated systems with built-in delays and high fees, and looking to stablecoins as a tool for real-time, cost-effective money movement. JPMorgan’s adoption of blockchain technology was the start of something bigger: the growing role of stablecoins in institutional finance.

Now, institutions like Mastercard are integrating stablecoins into their payment networks to improve settlement efficiency, reinforcing the broader trend of blockchain adoption in mainstream finance. Similarly, cross-border transactions—whether in corporate payments or consumer remittances—typically suffer from high costs and slow processing times, leading the companies that support them to search for new solutions. Stablecoins present a compelling alternative, allowing businesses to transact across borders with minimal friction.

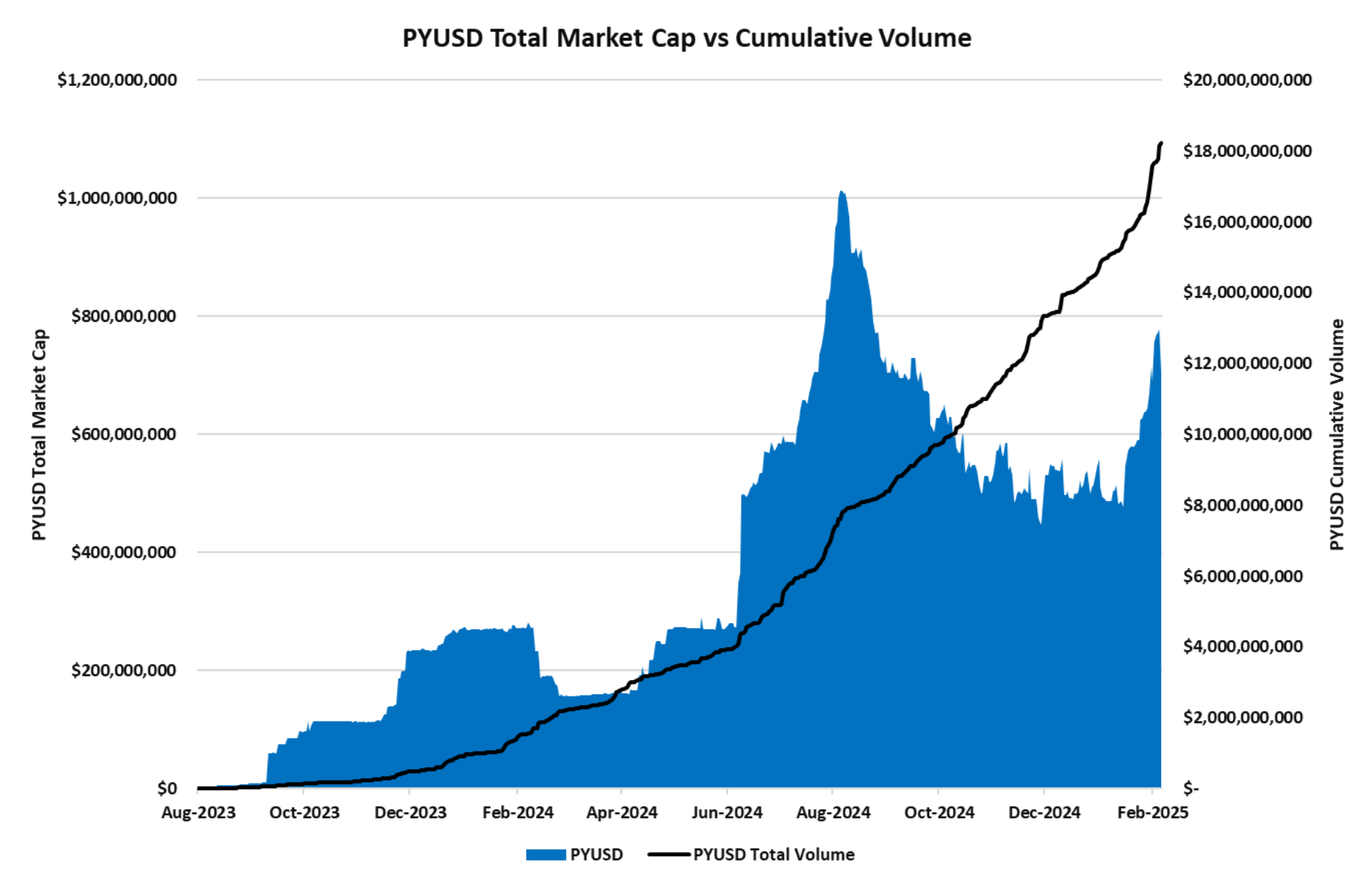

- PayPal: In August 2023, PayPal introduced its own U.S. dollar-backed stablecoin, PayPal USD (PYUSD), designed to facilitate seamless payments and transfers. This allows users to transact globally with minimal fees, as low as a fraction of a penny. PayPal plans to expand PYUSD's adoption among its over 20 million small-to-medium-sized merchants, enabling them to pay vendors and accept payments more efficiently.

Source: Defillama, Dune

- Visa: The global payment giant has expanded its stablecoin settlement capabilities by incorporating the Solana blockchain. Visa has conducted live pilots, moving millions in USDC between partners over Solana and Ethereum to settle fiat-denominated payments authorized over VisaNet. This integration aims to streamline cross-border transactions, reducing costs and processing times.

- Shopify: Through the Solana Pay integration, Shopify enables its merchants to accept stablecoin payments directly. This partnership allows for real-time, low-cost transactions, providing a compelling alternative to traditional payment methods. By leveraging stablecoins on the Solana blockchain, Shopify merchants can offer customers a seamless and efficient payment experience.

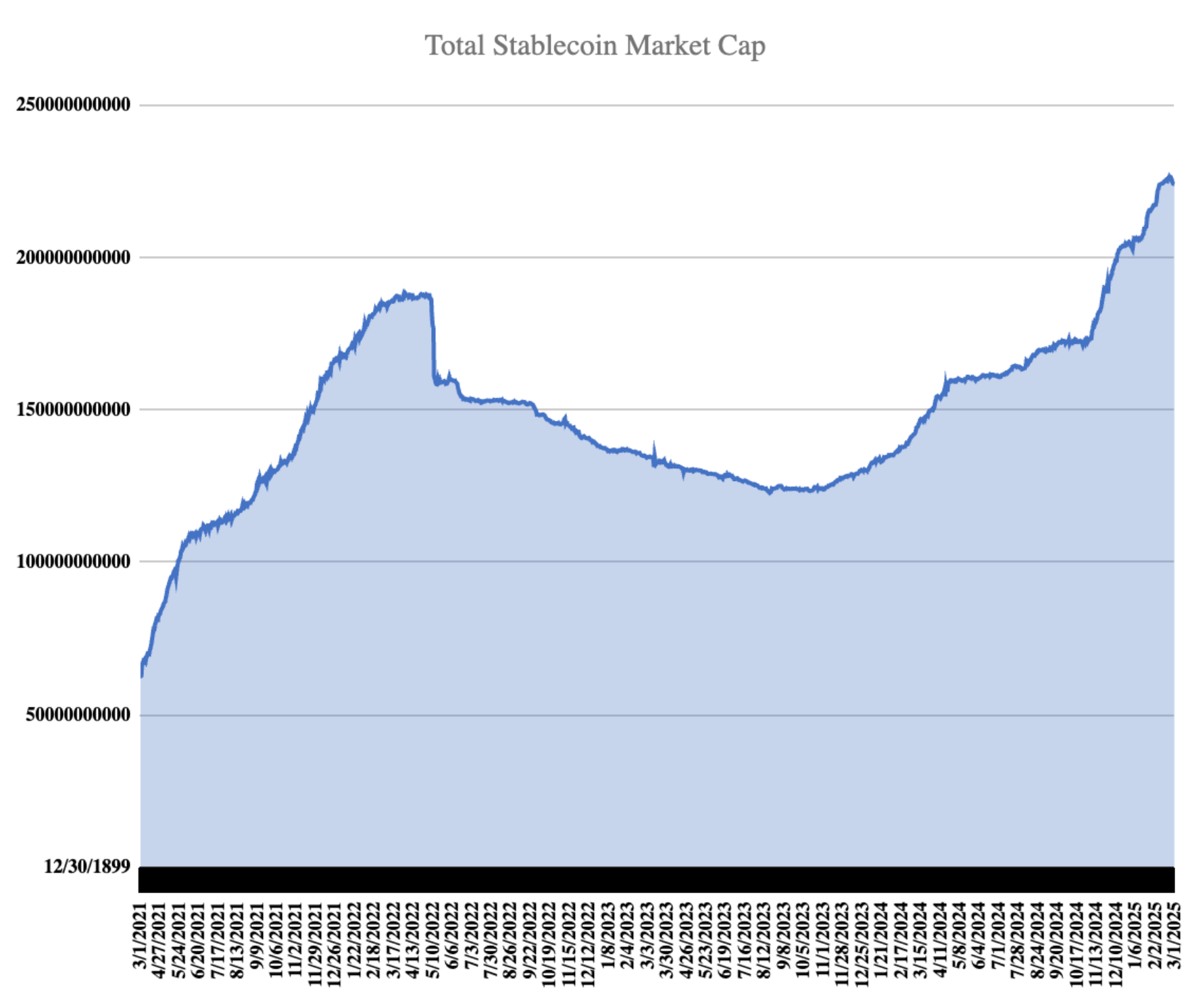

Source: Defillama

Beyond private sector initiatives, central banks and financial institutions are actively exploring blockchain-based solutions to enhance payment systems. Notably, Bank of America CEO Brian Moynihan announced plans to launch a dollar-backed stablecoin, contingent upon favorable legislation. This move aligns with the bank's strategy to innovate within the evolving digital currency landscape.

Simultaneously, the Federal Reserve is participating in Project Agorá, a collaborative effort with the Bank for International Settlements and other central banks. This project aims to make correspondent banking more efficient through tokenization, potentially allowing existing central bank reserves to be tokenized.

These initiatives reflect a broader shift as financial institutions and central banks integrate blockchain technology into traditional frameworks. Adopting stablecoins and other blockchain-based solutions modernizes payment infrastructures, reduces costs, enhances transaction speeds, and improves overall financial system efficiency and security.

What Enterprises Should Learn from JPM's Move

JPMorgan built Kinexys to solve a very specific problem—streamlining institutional settlements. But the core advantages of blockchain-based settlements extend far beyond banking.

The same benefits Kinexys provides—lower costs, faster transactions, and greater liquidity efficiency—are just as relevant for enterprises managing complex financial operations. From cross-border payments and treasury optimization to branded stablecoin issuance, blockchain presents a powerful opportunity for businesses to modernize how they move and manage capital.

This is where Bastion comes in. While JPMorgan is proving the validity of blockchain for institutional finance, Bastion helps enterprises unlock those same efficiencies through white-labeled branded stablecoins. By enabling businesses to access, move, and manage a stablecoins issued in their branded name, Bastion empowers them to achieve capital efficiencies similar to those adopted by leading institutions like JPMorgan.

Conclusion

JPMorgan’s Kinexys serves as a powerful case study of how blockchain technology is transforming institutional settlements. By leveraging stablecoins and blockchain, businesses can achieve faster, more cost-efficient, and transparent transactions—eliminating many of the inefficiencies of legacy financial systems.

As more institutions embrace blockchain for large-scale payments, stablecoins are poised to play an increasingly central role in the future of finance, offering a compelling alternative to outdated settlement processes.

"If the biggest bank in the U.S. is betting on blockchain-based settlements, the question isn’t whether enterprises should adopt this technology—it’s how they’ll do it in a way that best serves their business." For institutions looking to modernize their financial operations, the question is no longer if they should adopt stablecoins—but when.